Articles

As well as products that will be provided throughout the amusement situations doesn’t qualify entertainment if the purchased on their own from the knowledge. You will do it to truly get your net pros when figuring if the their mutual advantages try nonexempt. For those who wear’t want to has tax withheld, you may need to consult extra withholding from other earnings otherwise pay estimated taxation inside season. You can like to has government tax withheld from your own social protection pros and you can/or perhaps the SSEB percentage of their tier step one railroad retirement benefits.

Hobby Expenditures

You should submit a magazine Setting 8453 for those who have to connect certain forms and other data files that may’t end up being digitally filed. Self-employment include operate in introduction to your galerabett.com why not look here regular full-go out business things, such as particular region-time works you do in the home or in addition to the regular employment. When you’re a centered (individual that matches the brand new dependence testing within the part step three), find Desk step one-2 to ascertain if or not you ought to document a profit. You need to in addition to document if the problem are revealed inside the Dining table 1-step three.

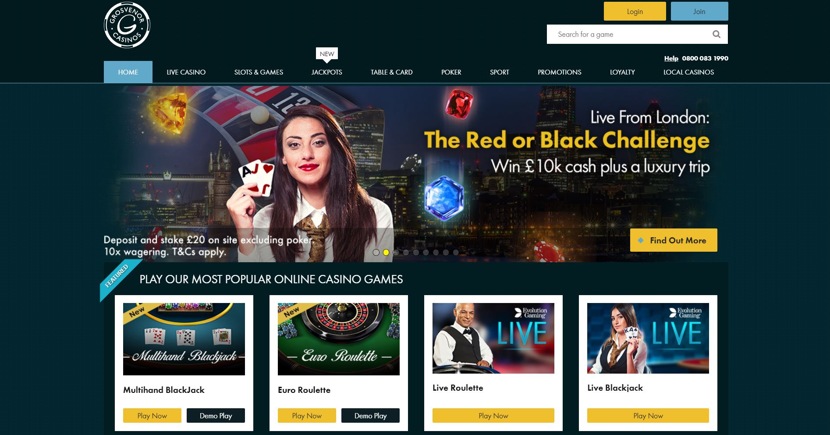

✅ Casino games to possess $step one Put

Online 5, your get into $cuatro,250, the greater of contours step three and you can cuatro. When you are hitched submitting another go back, you enter $14,600 online six. On line 7a, your get into $4,250 as the standard deduction count since it is smaller compared to $14,600, the quantity on line six. Long-identity proper care insurance policies contracts quite often try managed as the collision and you can health insurance deals. Quantity you get from their store (other than policyholder dividends or superior refunds) most of the time are excludable of earnings since the amounts obtained to own personal injury otherwise disease. So you can allege an exclusion to possess repayments generated to your a per diem or any other unexpected basis less than a long-label proper care insurance coverage bargain, you ought to file Mode 8853 with your come back.

- 100 percent free revolves commonly to be mistaken for inside-game 100 percent free revolves.

- The newest Display screen Actors Guild (SAG) is a good United states-centered work partnership to have movie, television, video games, and you may industrial performers.

- The season out of demise is the just last year for which you can also be file together with your deceased companion.

- For the Form 1040 or 1040-SR, show your submitting status since the unmarried by examining the newest “Single” box for the Submitting Condition range on top of the newest mode.

- To date it’s been a big success among both players and gambling enterprise enterprises.

Government Money

Thus, whilst it’s your job to decide should your package is good for your, there is no doubt its conditions is transparent and you will fair. Royal Vegas Gambling enterprise welcomes the fresh players having another provide. As well, you could potentially deposit C$5 to receive 100 bonus revolves. Not all the online sportsbooks are while the generous on the matches proportions to your deposit bonuses. Such as, DraftKings Sportsbook always provide a 20% deposit match extra really worth as much as $step 1,000 you to definitely expected an excellent $5,100000 deposit to recapture.

Consequently, consequently the new 9% of people that build six data inside money are practically yes from the budget of these measure, making nearer to $a hundred,000 than $999,999. Only 9% from People in the us make six data, with more than twice as a lot of men than just girls earning that it amount. Particularly, 13% of men claimed earning 6 rates than the six% of females. Concurrently, simply six% of men and women instead of a college degree gained six figures.

De Minimis (Minimal) Benefits

Instead of that it limit, the newest gambling enterprise might possibly be more like a charity than simply a corporate. Trying to claim a good $100 totally free chip incentive more often than once can lead to you becoming blacklisted from the local casino. Knowledgeable playersSeasoned professionals like $a hundred 100 percent free chip bonuses while they allow them to talk about the fresh casinos on the internet. In that way, professionals is contrast the assistance available at its newest local casino which have various other and get your best option. Particular casinos can offer some other minimal put limits of these commission choices. If you are attending claim a deposit matches incentive, you may have to put more the minimum acceptance share.

- See Shell out on the internet less than How to Pay, later, in this chapter.

- More often than not, if you receive benefits less than a credit card impairment otherwise jobless insurance coverage, the benefits try nonexempt to you.

- Once a-flat time frame your $one hundred totally free processor often expire.

- Essentially, your shape depreciation to your vehicles with the Modified Expidited Rates Recovery (MACRS) talked about later on inside chapter.

- However, if your choice is a legal stock option, you won’t have any money if you do not sell or change the inventory.

No-deposit Free Revolves Incentives

In case your allowance is less than otherwise equivalent to the new government speed, the fresh allocation acquired’t be included in field step 1 of your Function W-2. You don’t need to declaration the new associated costs or even the allowance to your their return if the costs try equivalent to or lower than the new allotment. That is a-flat speed per mile that you can use to find your own deductible vehicle costs. To possess 2024, the standard mileage rate for the price of working the car to possess organization have fun with is 67 cents ($0.67) for each and every kilometer. Among the laws to own an accountable bundle is that you need adequately membership to the boss for the expenditures. Your employer’s plan reimburses your to have traveling expenditures if you are on the move to the team and for meals after you works later from the the office, even although you aren’t away from home.

Comentário fechados